![]() For more information about adding a new debt

obligation see the short training video titled, “Adding and Editing Debt Schedules”.

For more information about adding a new debt

obligation see the short training video titled, “Adding and Editing Debt Schedules”.

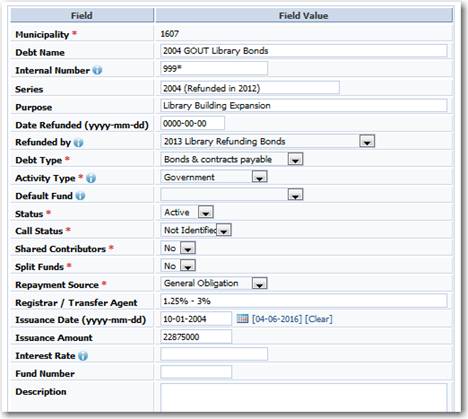

The first step in creating a new debt obligation is to add the debt header record for the obligation. The debt header record stores information that applies to the obligation itself and not a specific payment record which will be subsequently entered.

When entering debt obligations, you will find there are two distinct

types of obligations; Employee Accrued Compensation (EAC) and all others. The

tpye of information entered for EAC’s and the reporting format will differ from

the other types of obligations.

When entering debt obligations, you will find there are two distinct

types of obligations; Employee Accrued Compensation (EAC) and all others. The

tpye of information entered for EAC’s and the reporting format will differ from

the other types of obligations.

Internal Number: This is a number or identifying code that you have generated internally to identify each obligation as opposed to an official number that the bond market or agent may have generated.

Debt Type: Some transparency compliance requirements ask that the debt be reported by type of debt; for example, Bonds as opposed to Bank Loans. The Debt Type field gives you the opportunity to identify the type of debt being entered. You will be provided a drop down list of choices for the Debt Type entry.

Refunded by: If this obligation was refunded you can link this obligation to the obligation that was used to refund the original.

Activity Type: GASB requires debt to be reported by Fund Type. For this

reporting you identify Governmental Activity debt separate from Business Type

(Enterprise) or Component Unit debt. You will be provided a drop down list of

choices for the Activity Type entry.

Activity Type: GASB requires debt to be reported by Fund Type. For this

reporting you identify Governmental Activity debt separate from Business Type

(Enterprise) or Component Unit debt. You will be provided a drop down list of

choices for the Activity Type entry.

Default Fund: This is an optional field unless you choose to report your obligation amounts by specific fund and/or you utilize the split fund feature. The split fund feature permits you to enter one payment schedule but split the results on reports by percentage. In this case, obligations that are not split will need to have a single fund entered in this field. In order to see Funds in the dropdown, you will need to enter your specific funds. For more information about entering Funds see, Chart of Accounts Manager.

Status: The Status field is provided to determine if an obligation should be included in transparency reports. By default, an obligation will be added with the status of Active. Changing the status to Retired permits you to keep the obligation in the Munetrix database but eliminate it from transparency reports like the “Long-term Debt Detail report”.

Repayment Source: An important factor in a bond’s credit

quality is the source of repayment for the bond. There are three main sources of

repayment, and bonds are classified by these sources:

Repayment Source: An important factor in a bond’s credit

quality is the source of repayment for the bond. There are three main sources of

repayment, and bonds are classified by these sources:

General Obligation – A general obligation bond is paid through any revenues the issuer receives. This type of bond is also sometimes known as a “full faith and credit” bond. The issuer has agreed to levy taxes in an amount sufficient to make payments of principal and interest on outstanding bonds.

Revenue Bond – A revenue bond is repaid from the revenues of the project or system that the bond is financing rather than the municipal government’s general funds.

Tax-Backed – A tax-backed bond is repaid from certain tax revenues.

For more information visit the website of the Municipal Securities Rulemaking Board (Seven Questions to Ask When Investing in Municipal Bonds).

Fund Number: The Fund Number field is optional but allows for the storage of the chart of accounts fund number to which this obligation is recorded.

Interest Rate: Interest rates may be fixed for the duration of the debt or may change from year to year. The Interest Rate field in the debt header record is a place to store either the fixed rate for the debt or a range of rates for the duration of the payment schedule. This is a text field and will is not limited to numbers. You will be given the opportunity to enter interest rates by date when you enter the payment schedule for the debt.

Figure 48: Dialog box for adding a new debt obligation